With Brexit delayed, along with political stasis, project starts continuing to be stalled and high street retailers in trouble, the outlook for the UK construction industry is getting gloomier, industry economists believe.

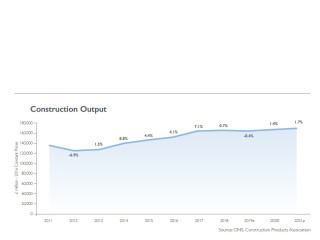

The latest forecasts from the Construction Products Association (CPA) anticipate overall construction output falling by 0.4% in 2019, revised down from a forecast three months ago of marginal growth of 0.3%.

In February the CPA was predicting 3% growth in UK construction output in 2020; now it is forecasting just 1.4% growth, largely driven by activity on major infrastructure projects but supported by sharp increases in warehouses and ports activity.

The forecast for 2021 has been upgraded from zero construction growth to growth of 1.7%.

The effects of continued Brexit uncertainty adversely affect sectors that require high upfront initial investment: commercial offices and industrial factories. An extended period of falls in new orders in both sectors highlights that uncertainty over long-term returns has made major expenditure on new floor space increasingly difficult to justify, the CPA economists say. Offices and factories output is forecast to fall 11.0% and 15.0% respectively in 2019, with further falls of 4.0% and 10.0% respectively in 2020.

Despite political and economic uncertainty, consumer spending has remained strong. However, retail construction is still forecast to fall 10.0% each year in 2019 and 2020. Investment in new retail space continues to be affected by the longer-term structural shift to online spending that has led to administrations and restructuring of traditional high street retailers and skewed retail demand towards storage, distribution and logistics facilities. As a result, industrial warehouses construction is forecast to rise over the forecast period. In addition, prolonged Brexit uncertainty and stockpiling has boosted demand for storage space further and warehouses output is forecast to rise by 15.0% in 2019 and 20.0% in 2020 to a record-high level of activity. This uncertainty also boosts demand in the ports sub-sector, where output is forecast to rise 12.0% this year and 10.0% in 2020.

Private house building activity is expected to remain flat over the forecast period, albeit at a high level, reflecting house-builder caution over the slowdown in demand and falling prices in London, as well as parts of the Southeast and East currently offset by buoyant housing markets of the Northwest, Yorkshire and the Midlands. In contrast, public housing starts are forecast to rise 2.0% in 2019 and 5.0% in 2020 supported by an increase in building for the affordable market.

The infrastructure sector is expected to experience the strongest growth rates across the forecast period, with growth of 9.3% forecast for 2019 and 9.7% for 2020, even with caution regarding government’s ability to deliver on major infrastructure projects such as HS2. Without this infrastructure growth, the construction industry would experience a 1.8% fall in 2019, followed by two years of stagnation.

CPA economics director Noble Francis said: “It’s a currently a mixed picture for the construction industry and fortunes will depend highly on the sector and region in which firms are working. Those involved in major infrastructure projects, warehouses or ports are enjoying considerable growth but firms working on offices, retail and factories will be experiencing falls in construction activity. In private house building, activity is falling sharply in London, as well as parts of the Southeast and East but activity in the Northwest, Yorkshire and the Midlands is continuing to grow in line with house price inflation.

“The endless Brexit uncertainty hasn’t affected activity on smaller projects, where households have largely switched off from reading about Brexit and continue to spend whilst employment is high and real wages are rising. However, the Brexit uncertainty has had a large impact on sectors dependent upon high upfront investment for a long-term rate of return, especially where the investment is from international investors. It has so far hindered investment in new offices towers, factories and high-end residential and, given a 12-18 month lag between new orders and activity on the ground, output in these sectors will be adversely affected in 2019 and 2020 at the very least. Conversely, the uncertainty has provided a boost to demand in small sub-sectors such as warehouses and ports, which are both expected to enjoy double-digit growth in 2019 and 2020.

“Overall, construction output is expected to fall marginally this year before 1.4% growth next year but this growth is highly dependent on government’s delivery of infrastructure. The CPA has always been very cautious about factoring in major infrastructure projects into the forecasts given the government’s consistently poor track record, highlighted most recently on Crossrail and HS2 but even recent announcements of revised dates and costs appear optimistic. This lack of project certainty, combined with Brexit uncertainty, means that firms are focused on day-to-day business, risk aversion and constraining costs rather than investment in capacity and skills needed for growth.”

The CPA adds an explanatory footnote that its forecasts are based on either one of the two most likely options regarding Brexit at this point occurring: either a revised version of the prime minister’s Brexit withdrawal deal is ratified following cross-party discussions prior to 22nd May (that would enable the UK to exit the EU on 1 June and enter the implementation period until 31 December 2020 so nothing changes in the near-term); or a further extension so that an alternative deal such as a customs union could be agreed upon and prepared for through an extension beyond 31st October.

Got a story? Email news@theconstructionindex.co.uk