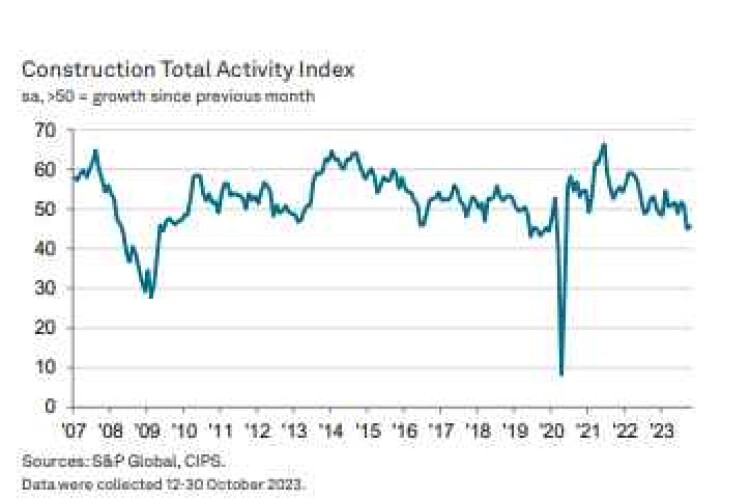

The headline seasonally adjusted S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in industry activity – hit 45.6 in October, up slightly from 45.0 in September. But it was still the second-lowest reading since May 2020 and confirmed a marked decline in total activity.

The construction PMI, based on monthly surveys of purchasing managers, is a seasonally adjusted index tracking changes in total industry activity. Any score above 50 indicates growth, below 50 shows activity slowing.

Companies cited a lack of new work to replace completed projects, fragile client confidence and rising borrowing costs as the main reasons for weaker sales.

An easing of materials supply conditions and falling demand helped push down purchasing prices. Moreover, the latest decline in input costs was the steepest since August 2009. Reduced workloads also led to a decline in subcontractor charges for the first time in over three years.

House-building activity declined at a steeper rate than any other sector, registering only 38.5 on the index. This was the eleventh successive month of decline for house-builders. A fall in demand (due to rising mortgage rates and the ongoing cost of living crisis) stifled residential construction activity.

Civil engineering activity also decreased sharply in October (index at 43.7) and the rate of decline here was the steepest since July 2022. The commercial building sector fared rather better with only a marginal decline and at a slower rate than in September (index at 49.5).

Total new work fell for the third month running in October and the rate of contraction matched that of May 2020. Many survey respondents commented on a lack of tender opportunities and lengthier decision-making among clients due to concerns about the broader economic outlook.

Business confidence also fell for the third month in a row as concerns persist over dwindling pipelines of construction work. Around 37% of the survey panel forecast a rise in business activity during the year ahead while 19% expect work levels to decline.

The degree of optimism registered in October was the lowest so far this year. Several respondents cited the weakening in the house-building sector and the impact of higher interest rates.

The softer demand for construction materials last month resulted in pressure on suppliers to offer discounts. The latest survey indicated that overall purchasing prices decreased at the fastest pace for over 14 years as lower timber, steel and transport costs were passed on by vendors.

A similar trend was noticed elsewhere in the supply chain with a strong rise in the availability of sub-contractors and a corresponding fall in the rates for sub-contract work, the first time these rates have fallen since July 2020.

Tim Moore, economics director at S&P Global Market Intelligence, which compiles the survey said: "October data highlighted another solid reduction in UK construction output as elevated borrowing costs and a wait-and-see approach to new projects weighed on activity.

"Total new work continued to fall more quickly than at any time since the initial pandemic lockdown period, which contributed to shrinking demand for construction products and materials during October. Competitive pressure on suppliers to pass on lower commodity prices resulted in the fastest decline in input costs since August 2009”.

Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), said: “High interest rates and low consumer demand for new homes continue to drag down the UK construction sector, with a lack of new tender opportunities and a cutback of existing projects being reported across the house building industry.

“The silver lining is that high borrowing costs are having their intended effect of putting the brakes on rising inflation. Previously suppliers were able to hike their prices in response to soaring demand. Falling construction activity has now tilted the negotiations in favour of buyers and suppliers are having to pass on lower prices for raw materials like timber and steel.”

Industry response to the latest survey has been predictably downbeat.

Fraser Johns, finance director at Beard Construction said: “Despite a stabilisation of commercial building, the headlines will be the eleventh straight monthly fall in housebuilding which is having a major impact in skewing overall activity and the wider industry picture. Despite the positive news of the Bank of England holding rates, elevated borrowing costs and tighter access to credit remains a clear challenge. This is not unique to the residential space either and partnered with wider economic uncertainty may be causing some clients to hesitate when committing to new projects.

“There’s no question though that it will be a tough end to the year for UK construction and for many firms, with some smaller firms potentially not making it that far amid a growing number of insolvencies. At Beard, we’re in the fortunate position to see positive signs of demand, particularly from infrastructure projects for local frameworks, which continue to drive our pipeline. In particular, education remains a buoyant area as schools and universities not only look to improve existing infrastructure but expand too.

“As ever, a careful eye is needed on tendering and cost plans in the current climate, as well as a constant dialogue with clients and suppliers. As parts of the industry face greater pressure, we must also respond to opportunities in the most resilient sectors.”

Accountancy firm PwC UK is forecasting a real overall decline in construction spend of -5% in 2023 before returning to growth in 2024/35. Commenting on the latest Construction PMI, PwC financial restructuring partner Toby Banfield said: “The degree of optimism signalled by the survey in October was the lowest so far this year. In addition to the macroeconomic outlook, the drop in optimism may not be surprising, given there have been a number of high profile insolvencies across the sector in recent months. This can significantly impact developers who need to find alternative contractors to complete projects, normally at a substantially higher cost than envisaged in the original design and procurement phase.

“Increasingly, developers and major contractors are looking at the resilience of their supply chains and considering contingency plans in the event a key contractor was to fail, with a reduced focus on new build opportunities.”

Brian Smith, head of cost management and commercial at infrastructure consultancy Aecom, said: “Our data suggests the rate tender price inflation and material costs have eased to lower levels, but wages continue to rise at around five per cent. Many firms have also yet to fully refinance their operations at new interest rates which will undoubtedly put pressure on working capital.

“Contractors looking to build their order books will find some solace in targeting retrofit and decarbonisation work but, more broadly, we would anticipate project starts and new orders remaining underwhelming into the New Year.”

Got a story? Email news@theconstructionindex.co.uk