The construction industry’s leading companies are bouncing back from the worst of the Covid-19 pandemic and the shock of Brexit; turnover and profits are improving – but challenges remain.

The Construction Index’s latest Top 100 shows leading construction contractors altogether earned £70.4bn in revenue, according to accounts available at Companies House as of the end of July 2022. This was an increase of just 3.2% on the previous year’s results for the same companies.

But turnover has increased at 62 of the Top 100 and there has been a massive upswing in terms of profitability.

Only 14 firms in the Top 100 registered a loss in their latest accounts. For many of those business, which include Tarmac Trading, Mace, NG Bailey and McLaren, the most recent figures available at Companies House for were for 2020, when the pandemic was wreaking the most financial damage.

As a result, a combined profit for the Top 100 could have been even greater than the £1,404m we see here. This aggregate profit was a huge improvement on the previous trading year, when the same 100 companies posted an aggregate loss of £43m.

The reason for the huge swing is that the majority of the annual results posted here are compared to a previous accounting period that was caught up in the eye of the pandemic. Companies including Kier, Amey and Multiplex posted huge deficits in their previous year’s trading and that dragged the overall figure into the red.

Taking away the losses posted by those three companies, the rest of the Top 100 generated profits of £450m in the previous year. That is perhaps a better illustration of the rebound in the industry’s fortunes.

Earnings are improving and profit warnings from companies listed on the UK stock market are at record low levels. A spread of work is allowing larger companies to rebuild their balance sheets but only one contracting family, the Kirklands (owners of Bowmer & Kirkland, which is ranked 16 on turnover in the latest TCI Top 100) still features on the latest Sunday Times’ Rich List.

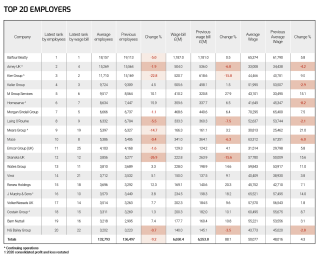

The industry does remain a major part of the UK economy and the Top 100 employ more than 219,000 people directly, but while the majority of leading contractors have recovered there have still been casualties.

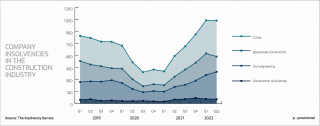

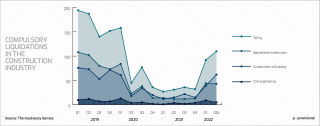

Over the past year, NMCN and Midas – ranked 41 and 62 respectively in last year’s Top 100 – both collapsed and insolvencies started to rise significantly at the start of 2022 as government support and credit forbearance dissipated. The collapse of even a mid-sized main contractor inevitably gains more media coverage but it is the specialist contractors who are bearing the brunt of tighter conditions.

In the first six months of this year, the number of construction companies becoming insolvent doubled to 2,082. More than half (1,082) of these corporate failures were specialist contractors. The number of specialist contractors being liquidated has also more than tripled over that same time period.

An added pressure began in March 2022, when the first repayments were due to be made on loans made through the Coronavirus Business Interruption Loan Scheme. CBILS closed to new applications at the end of March 2021and businesses were given 12 months before starting to make repayments on loans of up to £5m over six years. The early signs for construction are not good.

A Freedom of Information request by accountant Price Bailey to the British Business Bank found that 2,000 of the 97,000 businesses awarded CBILS loans defaulted on repayments in the first few months. The default rate for construction is 2.5% – more than twice that of other sectors, such as arts and entertainment (1.3%) and healthcare (0.8%).

Price Bailey partner Chand Chudasama said: “The surging level of CBILS defaults in the construction industry suggest that we are likely to see a high level of business failures for many months to come. Construction businesses are contending with both shortages of materials and labour and rising costs. Supply chain disruptions are making it harder for businesses to finish jobs to schedule and avoid financial penalties for late completion.”

The problem for contractors facing financial pressure from so many angles is the industry’s endemically low profit margins. Improving that measure has been a priority as the industry emerges from the worst of the pandemic. Profit margins improved at 67 of the companies in the Top 100 but the average pre-tax profit margin was still only 2.03%, though 53 companies surpassed that median level.

Boosted by development work, Henry Boot had the Top 100’s best profit margin of 15.2% ahead of Scottish contractor RJ McLeod on 13%. With no debts, McLeod was able to finance a 19% rise in the size of its workforce and a 58% rise in wages to support an 84% increase in turnover.

Cash remains king in the construction industry, where profits remain significantly out of kilter compared with allied industries such as housebuilding. Here, double digit margins are the norm but just seven members of the latest Top 100 operated to a profit margin of 10% or more in their latest accounts.

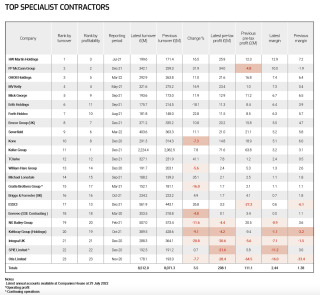

Despite more specialist contractors going under than main contractors, the bigger players among the specialists in the supply chain appear to be making more money.

There are 23 specialist contractors in the Top 100, which produced turnover of £8.5bn and their overall profits ballooned by 87%. Five of the specialist contractors in the Top 100 traded in the red but as a cohort, profit margins leapt to 2.44% from 1.38% in the previous year.

In the immediate future, contractors across the industry are going to be further challenged by rising material prices and labour costs.

Build cost inflation hit 12% in 2021 according to the Building Cost Information Service, while the Hays/BCIS Site Wage Cost Index shows all-in site rates leapt 11% in the first quarter of 2022 on the same period a year earlier. BCIS expects build costs to rise a further 7% in 2022. These price increases appear to be exacerbating delays in work moving through the procurement pipeline.

“Firstly Covid restrictions and latterly material and labour supply issues, have delayed work on site, prompting contractors to reschedule their development programmes,” says Allan Wilén, economics director at building research group Glenigan. “Material cost and availability issues may also be prompting contractors and clients to reappraise the design and costing of planned projects.”

Research by Glenigan found a 23% increase in the time typically taken for a project to progress from detailed planning consent being secured to work starting on site. In pre-pandemic 2019, this measure was 16 weeks but in 2021 the time lag averaged 21 weeks.

Delays to the start of a project slows income and piles financial pressure on contractors, particularly larger players, which generally need a certain amount of volume to operate.

BCIS expects that materials prices will continue to increase, albeit at a slower rate. One solution for larger contractors is to forward-purchase materials and stockpile them in yards and warehouses. Willmott Dixon has started to use this strategy across several projects this summer as the group looks to combat rampant inflation.

Graham Dundas, chief financial officer at Willmott Dixon, explains: “The biggest impact for us is that we do a lot of work via frameworks and repeat business. What you could buy for £20m a couple of years ago you can’t build now.

“It’s about what risks you want to take and whether you want to keep feeding the machine. We don’t have turnover targets. We’ve always had a view that we’d rather go backwards than damage the business. With some of the corporate failures that we’ve seen, there’s been a significant link to growth and chasing turnover. There’s much more of a link now to margin growth.”

As a privately-owned business, Willmott Dixon does not need to satisfy institutional shareholders looking for short term growth. A handful of larger listed contractors in the TCI Top 100 have also grown profits on the back of smaller turnover, such as Balfour Beatty, Kier and Skanska, which is quoted on the NASDAQ Stockholm stock market.

Contractors and clients both need to be more selective, argues Dundas. He adds: “There is a danger with the inflationary pressures out there and what it means to budgets that it will bring back some of the old habits. Customers will need to decide if they want to keep on working with someone or work with an unknown contractor for a very low price.”

Those ‘old habits’ saw contractors putting in cut-throat low prices simply to ‘buy’ turnover and then often looking to produce a profit through claims for variations at the Technology & Construction Court. Contractors also used to withhold cash from the supply chain, which leads to increasing failures amongst specialists.

The solution to protect the bottom line – and jobs – is greater collaboration, says Karen Booth, chief financial officer at ISG. She says: “There must be a laser focus on delivering a sustainable margin and everyone has to play a role. Open and honest conversations and deep collaboration – looking for risk allocation that is fair and avoiding contractual behaviours are key to our industry becoming more reliable and predictable for all of our stakeholders.”

As the industry continues to emerge from the worst of the pandemic, the true cost of Covid-19 is only now beginning to emerge. Next year’s Top 100 should provide an indication of whether a shift to greater collaboration is being made to help the industry through the difficult times ahead.

The full TCI Top 100 chart can be seen in our Data News section, accessible by clicking on Top 100 links above or by navigating directrly to www.theconstructionindex.co.uk/market-data/top-100-construction-companies/2022

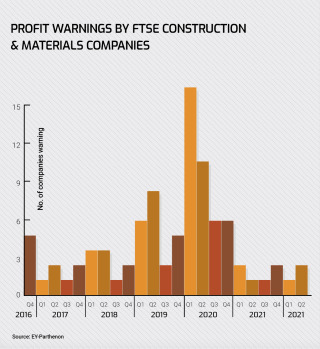

Profit warnings

The number of warnings by construction companies that profits will be lower than expected remains at an all-time low – but the figures disguise rising costs and supply chain pressures that are challenging the sector.

Consultant EY-Parthenon tracks profit warnings issued by all companies quoted on the UK stock markets and just three have been issued by construction firms this year, which is the same as a year ago.

Ian Marson, construction leader for the UK and Ireland at EY-Parthenon, says: “The construction sector is contending with an unprecedented level of cost, labour and supply chain stress, but this hasn’t affected all companies equally. Large companies with diverse portfolios have fared far better than small to mid-sized companies as they can absorb price increases and leverage their buying power in a tight market. Diverse portfolios held by larger companies have also helped buffer against slowdowns in one sub-sector or region.

“While the two main drivers of construction growth – housebuilding and government contracts – remain strong, sustained price increases could delay projects and it can take a while for the sector to feel the full impact of the economic slowdown.”

In the past 12 months only 8% of UK-quoted construction companies have cautioned about lower-than-expected earnings. The last time that warnings were consistently this low was in 2016.

The performance of the construction sector is running against wider economic trends and there has been a 66% rise in overall profit warnings in the first half of this year compared to a year earlier.

A record 58% of companies that issued profit warnings cited rising costs as one of the main reasons – up from 43% in Q1 – while 19% noted labour market issues. Both issues pose threats to the construction industry with steelwork group Billington warning of lower than expected profits in May due to volatile materials prices.

Marson adds: “The sector also needs to ensure it guards against complacency: it still has work to do to improve operational efficiency and to meet its own sustainability goals – as well as helping others achieve theirs”.

In total, of the 1,222 UK-listed companies, 70 have issued at least two consecutive warnings in the last 12months. On average, one-in-five companies de-list within a year of their third warning, most due to insolvency.

Alan Hudson, a partner at EY-Parthenon, said: “Businesses will need to prepare for lower growth, tighter capital and significant market volatility in the coming months. As profit warnings and stress levels rise, we’re starting to see more companies issue multiple profit warnings and a return of companies approaching the three-warning rule.”

Construction has generally remained unscathed as most listed companies in this sector are larger. However, contractor NMCN issued a string of profit warnings before collapsing last year and the cost of materials and labour is likely to remain key to earnings.

Insolvencies

The number of construction-related companies falling into insolvency in England and Wales has virtually doubled over the past 12 months.

Data from The Insolvency Service shows that 1,039 firms working in the construction industry went under in the second quarter of this year. That figure is only marginally ahead of the first three months of 2022 but up from 597 insolvencies in the second quarter of last year.

Kelly Jordan, a partner at commercial lawyers Womble Bond Dickinson, says: “It’s been a strange couple of years [due to the Covid-19 pandemic] and there has not been quite the anticipated effect on the insolvency markets but it’s starting to ramp up now.

“Previously there had been quite a lot of government support and credit forbearance that had suppressed the numbers to a very low level. But the financial assistance has fallen away and the appetite to crack on and pursue debt has started to bite.”

Specialist contractors continue to bear the brunt of the harsher economic conditions. In the 12 months to 30th June 2022, 2,152 specialist contractors became insolvent and collapses continue. Since then, subcontractors going under include mechanical and electrical outfit Kershaw, which collapsed owing suppliers nearly £10m, NWP and London-based Edge DBS.

Some companies have been saved, such as south London-based civil engineering contractor O’Keefe, which was rescued by Byrne Group, and civils and concrete frame specialist Woodmace, whose founder John Oak returned to rescue the business he founded.

Others have not been so fortunate. The number of construction companies being liquidated in England and Wales trebled in the 12 months to June 2022 and liquidations have continued including, in July, £56m-turnover offsite contractor Mid Group.

The government assistance provided during the pandemic appears to have sustained some companies that would otherwise have failed naturally. But the subsequent withdrawal of support has accelerated these failures and this trend looks set to continue.

“There has also been a spike in CVAs [company voluntary arrangements],” adds Jordan. “These are terminal events and businesses coming to the end of their life, which is not good for the rescue culture.

“Previously there had been a lot of assistance to keep businesses ticking over but not to save businesses so there have been a lot of problems storing up. With all the challenges that lie ahead, I don’t see the numbers coming down,” she says.

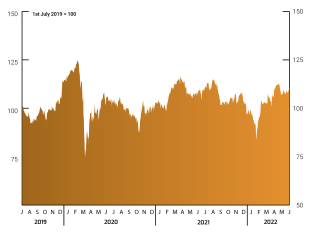

The TCI share index

The value of shares in contractors quoted on the UK stock markets have recovered but still remain below pre-pandemic levels, according to exclusive research for TCI.

The TCI share index, which is produced exclusively by the London Stock Exchange Group (LSEG), hit a four-year high in February 2020 but crashed by 40% a month later as the first of a wave of lockdowns was introduced.

The index gradually recovered and between February 2021 and January 2022 it never dipped below the 100-point mark.

However the resounding impact of Brexit pushed up materials prices and the cost of living. Both of these factors subsequently weighed heavily on construction industry share prices.

Many larger contractors defied doom-mongers with work across a breadth of sectors that supported their operations but the failure of one of the few remaining smaller listed contractors, NMCN, did little for the City’s appetite in low profit-margin contracting.

In February this year, the wider economic impact created by Russia’s invasion of Ukraine pushed the index to its lowest point since the outbreak of Covid-19 in 2020.

The index has recovered and by this summer was 3.7% ahead of the same point a year earlier, though still 11% down on its four-year high as fears over materials prices and labour rates weigh on the City’s sentiments towards shares in contractors.

Got a story? Email news@theconstructionindex.co.uk