The latest monthly survey of construction purchasing managers indicated that the so-called ‘beast from the east’ snowstorm restricted overall activity, lengthened delivery times and triggered the fastest drop in new orders since July 2016.

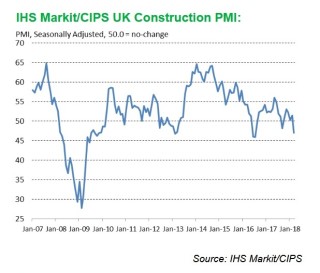

Although there remains widespread confidence that the industry will bounce back quickly enough as spring arrives, March saw the seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers’ Index (PMI) drop from 51.4 in February to 47.0 in March. It was the first time for six months that the index had dipped below the 50.0 no-change threshold and the fastest overall decline in construction output since July 2016.

The overall reduction in construction output was driven by the sharpest drop in civil engineering work for five years in March. Commercial activity also decreased during the latest survey period, with the rate of decline the most marked since September

2017. Housing bucked the wider trend for construction activity in March, although the latest upturn in residential building was only marginal.

Construction companies indicated a decline in new business volumes during March, which continued the downward trend seen so far in 2018. The latest deterioration in new order books was the sharpest since July 2016.

Survey respondents noted that subdued underlying demand and, in some cases, weather-related disruption had weighed on sales in March. Despite a sustained soft patch for new work, latest data revealed that employment growth accelerated to a three-month high.

At the same time, subcontractor availability continued to decline, which contributed to the strongest rise in their average prices charged since September 2017.

Higher raw material costs continued in March, which construction firms linked to increased prices for metals and insulation in particular. Nonetheless, the overall rate of input cost inflation softened to a 20-month low. Some survey respondents cited a moderation in supplier price rises linked to the weak pound.

Meanwhile, construction firms indicated that supplier lead-times lengthened to the greatest degree since last July. This was attributed to a combination of stretched supply chain capacity, alongside transport delays caused by the weather.

Tim Moore, associate director at IHS Markit and author of the IHS Markit/CIPS Construction PMI, said: “The construction sector continued to experience subdued business conditions during March, but snow-related disruption was a key factor behind the marked decline in activity on site reported by survey respondents.

“Total construction output fell at the fastest pace since July 2016, driven by the sharpest reduction in civil engineering activity for five years and a renewed fall in commercial work.

House building increased slightly during March, although the rate of expansion was still softer than at any time in 2017.

“A solid rise in employment numbers and the rebound in business expectations to a nine-month high provide an indication that construction activity will strengthen over the near-term. However, survey respondents noted that underlying demand remains constrained by heightened economic uncertainty and risk aversion among clients.”

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, said: “Civil engineering and commercial activity were the most affected, as housing became the best performer. However, the marginal improvement in residential building was softer than in most of 2017 indicating there may be something more serious ailing the sector, as respondents also cited continuing Brexit-related uncertainty and disappointment over the performance of the UK economy.

“There was some good news as purchasing levels increased slightly, sustained by the respite of pressure from cost increases which were the lowest since June 2016 and where the worst impact of the weak pound on prices may have dissipated. With the strongest job creation this year, firms had a more hopeful outlook for the coming months coupled with the highest level of optimism since June 2017, as they scoured the wider marketplace for opportunities.

“It’s a few years since the UK experienced such bad weather in March and it’s obvious that supply chains were woefully unprepared to deal with the disruption. So though March’s figures could be viewed as a temporary blip, without a strong pipeline of work, and strong risk strategies in place, the sector’s health remains in question as we’re still a long way off seeing it operate the way it has over the last year.”

Got a story? Email news@theconstructionindex.co.uk